A comprehensive guide for where and how to (1) pay...

Read MoreComplete List: Savings Accounts for Kids in the Philippines

An updated guide for Filipino parents who want to set up savings accounts for their children age 0-21

Helping our young kids set up their own savings accounts is a great way to both teach them about the benefits of saving and to encourage them to take responsibility for their own financial well-being, both now and in the future.

But if you’re reading this article, I’m sure you already know all that!

So: I’m going to go straight to the information that you’re here for and lay out the different banks in the Philippines that offer savings accounts for kids.

Specifically, this article will go into the following topics (clicking on the link will take you directly to that section):

- A very short discussion on the things you should consider when choosing a bank for your kids (and just to be clear, I am not affiliated with any of them, nor am I getting an incentive from any of them to write this post) — I put this section first so you can have a better idea what details to look out for when you look at the next section

- A full list of Philippine banks that offer savings accounts for kids, with details like interest rate, initial deposit, and maintaining balance — up-to-date as of April 2022 — plus links to the appropriate bank pages so you can always check for updated information

- The general requirements for opening a savings account for a minor, including what can be considered valid IDs

Which bank in the Philippines offers the best savings account for children?

As with all things “best” this is something very subjective and depends on a lot of personal factors. For example, we would all love a high interest rate, but if the one that offers the highest rate has only one branch, and it’s located in a part of the city that you would otherwise hardly ever go to, is the difference in interest really worth the cost of gas or public transport to get there? Probably not, particularly as interest rates are unbelievably low these days. But then again, if that bank has a pretty efficient online banking system, then yes, it might be worth the one-time hassle of opening the account if you can do everything else online.

These are the questions you should ask before deciding on where to take your child to open his/her own bank account.

Convenience

- Does your own bank offer a savings product for kids? Think of the convenience of doing one banking errand instead of two, already knowing your way around the system, being able to transfer funds easily, etc.

- Does the bank have a branch near where your family lives, where you work, or where your child goes to school? You want to lessen the barriers to good financial habits and having a branch at a convenient location makes everything easier.

Age

- Is your child eligible to open their own savings account at the bank? Some kiddie savings accounts can be opened as early as 0 years old, while some require that the child be at least 10.

- Until when can your child keep the account? Some junior savings accounts are only valid until the child is 12 — after which it gets converted to a regular savings account — while some last until your child reaches the age of 21.

Minimums

- Initial deposit – What is the minimum amount for opening the account?

- Minimum maintaining balance – What is the minimum amount that your child should store in the account to keep it active? If your child’s balance falls below this, the bank could charge fees and eventually close the account.

- Minimum balance to earn interest – Just because you are able to stick to the minimum maintaining balance doesn’t mean you are already eligible to earn interest on your money. Some banks even have a zero initial deposit and minimum maintaining balance but will require a balance of Php5,000 for the money to start earning interest.

Other factors

- Does the account come with an ATM card / debit card or only a passbook? Some accounts only give a passbook; some provide an ATM but only when the child reaches a certain age or when the account balance reaches a certain amount.

- What denomination is the savings account in? The banks listed below all offer savings accounts for kids in Philippine peso but at least two banks also offer a savings account for children in US$ denomination.

- What controls do parents have on the account? Some accounts let parents set a minimum balance that cannot be withdrawn.

- Are there other benefits offered with the account? For example, some accounts come with personal accident insurance worth five times the average daily balance, while others provide free medical and dental services subject to certain conditions.

Banks with Kiddie Savings Accounts in the Philippines

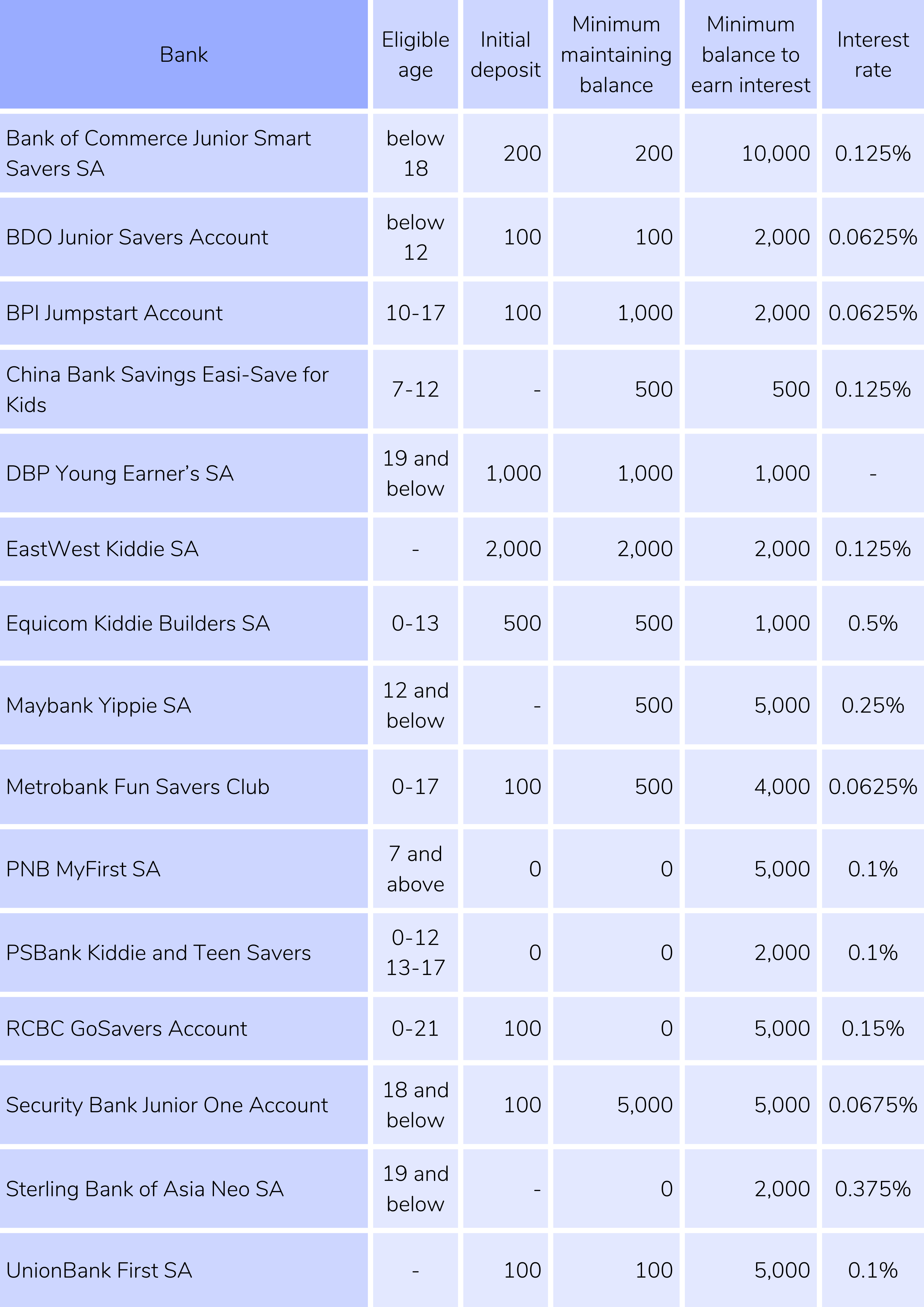

Here’s a table that will give you an overview of the different savings accounts products available for kids in the Philippines, and then we’ll go into more detail below the table.

As always, this information has been verified and validated using the information provided in the official websites of the respective banks at the time of writing. But things do change. For example, UCPB used to have a Start2Save Junior Savings Account, but the page for that particular product now gives an error message, which may have something to do with the recent UCPB – Landbank merger. So, further below, I’ve included a link to the specific page in each bank website with details on their savings account for kids so that you can (and should) check for the latest information before you go to the bank to open an account.

Details that are particularly worth noting — such as the highest interest rate or the lowest minimum balance to earn interest — are italicized and/or in a different color in the sections below the table so that they’re easier to spot.

Bank | Eligible age | Initial deposit | Minimum maintaining balance | Minimum balance to earn interest | Interest rate |

|---|---|---|---|---|---|

Bank of Commerce Junior Smart Savers Savings Account | below 18 | 200 | 200 | 10,000 | 0.125% |

BDO Junior Savers Account | below 12 | 100 | 100 | 2,000 | 0.0625% |

BPI Jumpstart Account | 10-17 | 100 | 1,000 | 2,000 | 0.0625% |

China Bank Savings Easi-Save for Kids | 7-12 | - | 500 | 500 | 0.125% |

Development Bank of the Philippines Young Earner’s Savings Account * | 19 and below | 1,000 | 1,000 | 1,000 | - |

EastWest Kiddie Savings Account | - | 2,000 | 2,000 | 2,000 | 0.125% |

Equicom Kiddie Builders Savings Account | 0-13 | 500 | 500 | 1,000 | 0.5% |

Maybank Yippie Savings Account | 12 and below | - | 500 | 5,000 | 0.25% |

Metrobank Fun Savers Club * | 0-17 | 100 | 500 | 4,000 | 0.0625% |

PNB MyFirst Savings Account | 7 above | 0 | 0 | 5,000 | 0.1% |

PSBank Kiddie and Teen Savers | 0-12 13-17 | 0 | 0 | 2,000 | 0.1% |

RCBC GoSavers Account | 0-21 | 100 | 0 | 5,000 | 0.15% |

Security Bank Junior One Account | 18 and below | 100 | 5,000 | 5,000 | 0.0675% |

Sterling Bank of Asia Neo Savings Account | 19 and below | - | 0 | 2,000 | 0.375% |

UnionBank First Savings Account | - | 100 | 100 | 5,000 | 0.1% |

“-” means this was not specified in the bank website

* DBP and Metrobank also have savings accounts for kids in USD ($) denominations

Bank of Commerce Junior Smart Savers Savings Account

- Age: below 18

- Initial deposit amount: ₱200

- Minimum maintaining balance: ₱200

- Minimum balance to earn interest: ₱10,000

- Interest rate: 0.125%

- Other details:

- With passbook and Mastercard debit card

- More info here: https://www.bankcom.com.ph/personal/deposit-accounts/savings/ – scroll down to the Junior Smart Savers section

BDO Junior Savers Account

- Age: below 12

- Initial deposit amount: ₱100

- Minimum maintaining balance: ₱100

- Minimum balance to earn interest: ₱2,000

- Interest rate: 0.0625%

- Other details:

- With passbook; debit card can be requested upon reaching ₱2,000 balance

- More info here: https://www.bdo.com.ph/personal/accounts/peso-savings-account/junior-savers/account-feature

- Info on requirements, fees and charges here: https://www.bdo.com.ph/personal/accounts/peso-savings-account/junior-savers/open-an-account

BPI Jumpstart Account

- Age: 10-17

- Initial deposit amount: ₱100

- Minimum maintaining balance: ₱1,000

- Minimum balance to earn interest: ₱2,000

- Interest rate: 0.0625%

- Other details:

- Parents can set a minimum balance that cannot be withdrawn

- More info here: https://www.bpi.com.ph/bank/savings/jumpstart

China Bank Savings Easi-Save for Kids

- Age: 7-12

- Initial deposit amount: not specified

- Minimum maintaining balance: ₱500

- Minimum balance to earn interest: ₱500 – lowest among the banks in the list

- Interest rate: 0.125%

- Other details:

- With passbook

- Interest is credited monthly

- For children below 7 years old, an account may be opened through an In-Trust For (ITF) arrangement

- More info here: https://cbs.com.ph/personal/deposit_products/savings_accounts/Easi_Save_For_Kids.aspx

Development Bank of the Philippines Young Earner’s Savings Account

- Age: 19 and below

- Initial deposit amount: ₱1,000

- Minimum maintaining balance: ₱1,000

- Minimum balance to earn interest: ₱1,000

- Interest rate: not specified

- Other details:

- Also offers a USD savings account for kids, with an initial deposit of $50 and minimum daily balance of $100

- More info here: https://www.dbp.ph/personal-banking/deposit-products/young-earners-savings-account/

EastWest Kiddie Savings Account

- Age: not specified

- Initial deposit amount: ₱2,000

- Minimum maintaining balance: ₱2,000

- Minimum balance to earn interest: ₱2,000

- Interest rate: 0.125%

- Other details:

- With passbook

- More info here: https://www.eastwestbanker.com/deposits/pesosavings – scroll down to Kiddie Savings

Equicom Kiddie Builders Savings Account

- Age: 0-13

- Initial deposit amount: ₱500

- Minimum maintaining balance: ₱500

- Minimum balance to earn interest: ₱1,000

- Interest rate: 0.5% – highest among the banks listed here

- Other details:

- Entitled to free dental and medical benefits from Maxicare when the account balance reaches ₱15,000

- More info here: https://www.equicomsavings.com/product-and-services/deposits/ – scroll down to Kiddie Builders Savings Account

Maybank Yippie Savings Account

- Age: 12 and below

- Initial deposit amount: not specified

- Minimum maintaining balance: ₱500

- Minimum balance to earn interest: ₱5,000

- Interest rate: 0.25%

- Other details:

- Free personal accident insurance equal to 5 times the previous month’s average daily balance (up to a maximum of ₱500,000)

- With passbook and regional ATM card that can also be used at Maybank ATMs in Malaysia, Singapore, Cambodia and Brunei without charge

- More info here: https://www.maybank.com.ph/en/personal/deposits/savings/yippie-savings-account.page

Metrobank Fun Savers Club

- Age: 0-17

- Initial deposit amount: ₱100

- Minimum maintaining balance: ₱500

- Minimum balance to earn interest: ₱4,000

- Interest rate: 0.0625%

- Other details:

- Passbook

- Free personal accident insurance

- Additional educational trust benefits in the event of the accidental death of the parent or guardian

- Also offers a USD savings account for kids, with an initial deposit of $100 and minimum daily balance of $100

- More info here: https://www.metrobank.com.ph/save/savings/fun-savers-club-savings-account

PNB MyFirst Savings Account

- Age: 7 and above

- Initial deposit amount: ₱0

- Minimum maintaining balance: ₱0

- Minimum balance to earn interest: ₱5,000

- Interest rate: 0.1%

- Other details:

- Comes with debit card or passbook

- More info here: https://www.pnb.com.ph/index.php/my-first-savings

PSBank Kiddie and Teen Savers

- Age: 0-12 for Kiddie Savers / 13-17 for Teen Savers

- Initial deposit amount: ₱0

- Minimum maintaining balance: ₱0

- Minimum balance to earn interest: ₱2,000

- Interest rate: 0.1%

- Other details:

- Free personal accident insurance from AXA Philippines up to five times the average daily balance

- The Kiddie Savings (0-12) may be opened as an individual account for each child, a joint account, or an In-Trust-For (ITF) account

- With passbook; ATM card issued upon request (except for ITF accounts)

- More info here: https://www.psbank.com.ph/deposits/savings/saving-products-lists/psbank-kiddie-and-teens-savings

RCBC GoSavers Account

- Age: 0-21

- Initial deposit amount: ₱100

- Minimum maintaining balance: none

- Minimum balance to earn interest: ₱5,000

- Interest rate: 0.15%

- Other details:

- With passbook and MasterCard debit card

- More info here: https://www.rcbc.com/gosavers

Security Bank Junior One Account

- Age: 18 and below

- Initial deposit amount: ₱100

- Minimum maintaining balance: ₱5,000

- Minimum balance to earn interest: ₱5,000

- Interest rate: 0.0675%

- Other details:

- With a passbook and/or Mastercard debit card

- For children 6 years old and below, the account should be opened as an ITF account

- More info here: https://www.securitybank.com/personal/accounts/children-account-junior-one-savings

Sterling Bank of Asia Neo Savings Account

- Age: 19 and below

- Initial deposit amount: any

- Minimum maintaining balance: none

- Minimum balance to earn interest: ₱2,000

- Interest rate: 0.375%

- Other details:

- With a passbook and Visa debit card

- More info here: https://www.sterlingbankasia.com/personal/deposit/neo-savings-account

UnionBank First Savings Account

- Age: not specified

- Initial deposit amount: ₱100

- Minimum maintaining balance: ₱100

- Minimum balance to earn interest: ₱5,000

- Interest rate: 0.10%

- Other details:

- With a Visa debit card for minors at least 7 years old

- More info here: https://www.unionbankph.com/accounts/first-savings

Savings Accounts for Minors: General Requirements

Although it’s best if you check the requirements for opening a children’s savings account with the actual bank with which the account will be opened, these are the usual documents required.

Child’s documents

- The child’s valid ID – a passport or PhilSys ID (national ID) will work best for this

- School ID with the child’s photograph

- An alternative if the child doesn’t have a passport or national ID

- Some banks require that the school ID should be valid (not expired) and signed by the principal or school head

- Birth certificate issued by the Philippine Statistics Authority (PSA, also known as NSO) or Certified True Copy issued by the Local Civil Registrar (LCR)

- This is often named as an alternative to the IDs already listed above, but even if your child has a passport, national ID, or school ID, I suggest you bring their birth certificate so you can prove that you’re the parent and you have the standing to make decisions (such as opening an account) on their behalf.

Parent’s documents

- Valid government-issued ID (some banks require two) with photo and signature

- If you’re not the natural mother/father, you will also need to present documents that prove your legal standing, such as:

- Adoption documents

- Guardianship documents

- Court order assigning the child as your ward

- Proof of billing with your name and address

- Banks mostly require this when adults open a bank account, and of course children will not usually have their own bills addressed to them, but you could bring yours just in case.

The bank may also have a form that you need to fill out (and that you can fill out in advance) and, of course, you will need to bring the minimum initial deposit, if any.

That’s it!

Here’s to health, happiness and financial wellness for all of us!

In the mood for more adulting? ^_^ Check out our other articles — hey, we’re in this together!

Financial Literacy Worksheets for Children: An Introduction to Financial Education

Interactive/printable worksheets for elementary-age children to introduce and reinforce the...

Read MoreTuition Fees of Montessori Schools in the Philippines

The yearly tuition and other school fees of some of...

Read More13 Lessons Your Kids (And You!) Can Learn From Warren Buffett

Warren Buffett, the American billionaire and philanthropist, is not only...

Read MoreLEARNING AND GROWING

Learning / Education

Financial Education for Kids

Inspiration for Kids

LEARNING ABOUT THE WORLD

Books

Environmental Issues

Philippine Heritage and Culture

World History, Arts and Culture